Guilty without the guilt? The Chekalins' spouses bring hundreds of millions of rubles a year to the budget

Ivan Zubov

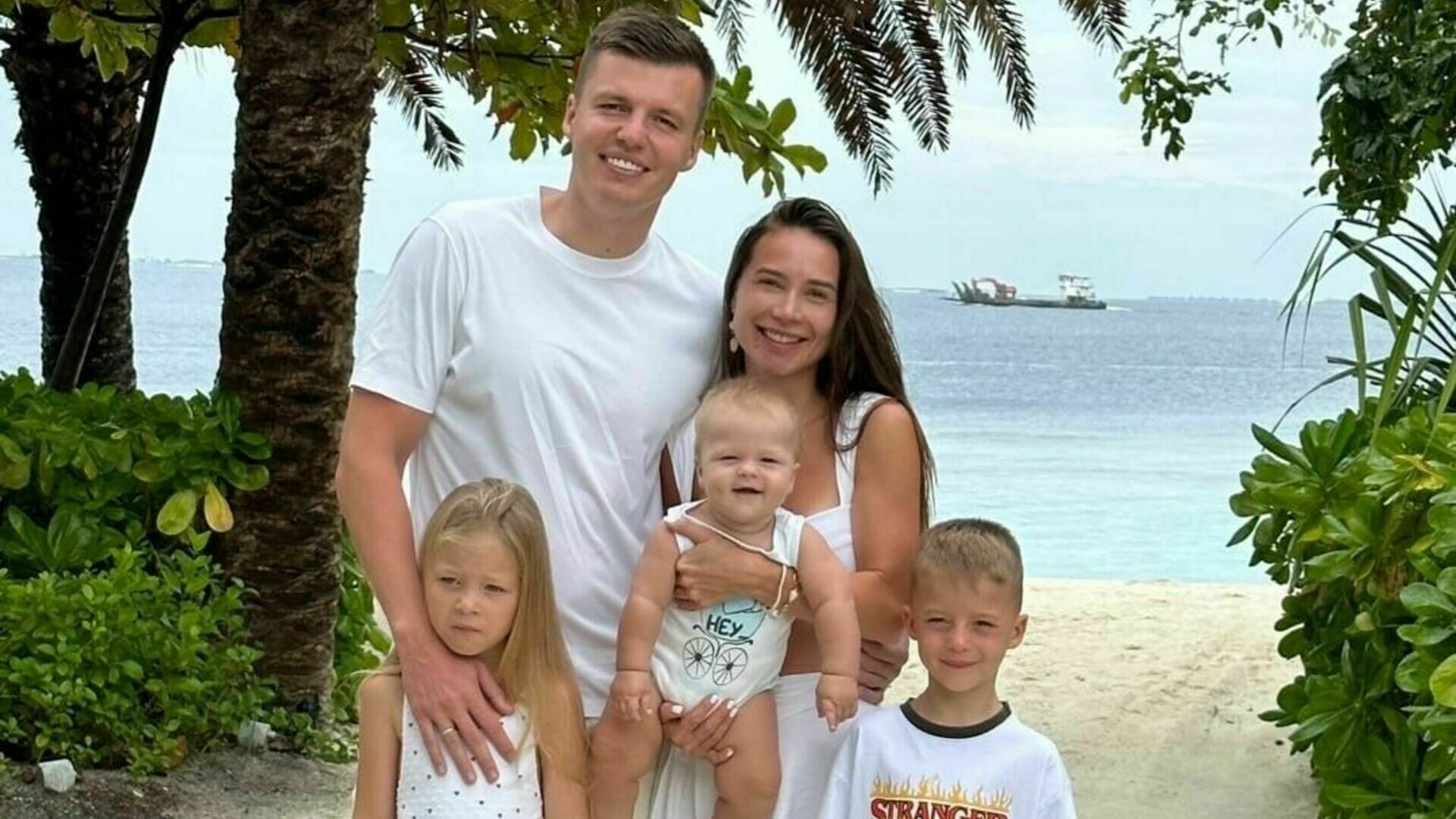

At the end of last week, the Russian media and social networks amicably reported on a criminal case against the bloggers-the spouses of the Chekalins on tax evasion in the amount of 300 million rubles, as well as that during searches in the house of Valeria Chekalina, security forces found a lot of luxury items, expensive cars, jewelry and a collection of gold bullion.

The couple earned their money by running fitness marathons, but according to investigators, Valeria Chekalina "carried out the fragmentation of the business" selling fitness marathons and registered part of her income to her spouse and other relatives.

And now there has been an unexpected turn in the Chekalins' case. As follows from the published accounting statements, they can be recognized as the largest taxpayers in their field, performing their duties in good faith. Alexander Khaminsky, a tax lawyer, head of the Law Enforcement Center in Moscow and the Moscow Region, shared details on this matter:- In addition to social media accounts with 15 million subscribers for two, the Chekalina couple own a successful offline business specializing in the retail of cosmetic products.

Their main commercial asset – the company "Bi Fit" – operates through 64 retail outlets located in popular shopping and entertainment centers in major cities not only in Russia, but also in the CIS countries. The company's turnover for 2019-2021 amounted to about 3.5 billion rubles, net profit exceeded 1.0 billion rubles. Taking into account the fact that Valeria Chekalina owns 75% of Bi Fit, her dividends in just three years can amount to more than 750 million rubles. It turns out that the blogger's income clearly exceeds her expenses. The financial statements for 2022 have not yet been published, but judging by the activity of buyers and due to the withdrawal of foreign competitors from the Russian market, financial indicators will only grow.

Let's see how the relationship between Bi-Fit and the state develops in the tax sphere. As follows from the tax returns, in 2021 the company accrued and transferred to the budget 250.0 million rubles of value added tax and 190.0 million rubles of income tax. During the same period, contributions to social funds exceeded 64.0 million rubles. As of the end of the year, overdue taxes amounted to only 129 rubles in personal income tax, the Federal Tax Service had no other claims against the company.

As for the income and tax obligations of individual entrepreneurs, due to the status of individuals, their reports have not been officially published. However, information on the availability of existing inspections and court cases is publicly available. Since the moment of state registration in respect of IP Chekalina V.V., scheduled and unscheduled inspections of control and supervisory authorities have not been appointed. As of March 8, her bank accounts were not blocked by the decision of the IFNS. This means that there are no claims against IP Chekalina V.V. from the tax authorities. The only court proceedings on the recovery of 3.3 million rubles from Orenburg LLC Chernoebeloe ended in favor of the plaintiff. The situation is similar for IP Chekalin AA, the wife of Valeria. There are no claims from the tax authorities, the accounts are valid, does not participate in court proceedings.

It should be noted that today the services of the Federal Tax Service for the verification of counterparties officially provide interested parties with information about the presence or absence of blocking of current accounts on the grounds attributed to the competence of the service. Moreover, this information is an electronic document certified by an electronic digital signature of an official. Thus, in the registers of automated information systems (AIS) of the Federal Tax Service, there is no information about tax claims against the Chekalin spouses as individual entrepreneurs and owners and managers of legal entities. It is obvious that the investigating authorities, initiating a criminal case under Article 198 of the Criminal Code of the Russian Federation, were guided by some other reasons and grounds. However, since March 2022, such procedural actions must necessarily be based on non-compliance with the decision of the tax authority to bring to tax liability. But these circumstances will be the subject of judicial proceedings already within the framework of criminal procedure legislation.