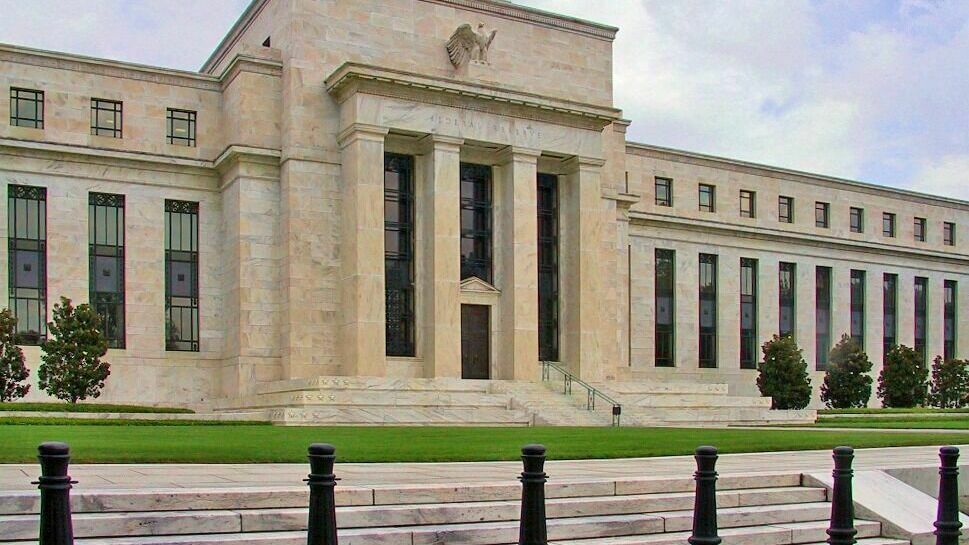

The Federal Reserve System raised the key rate to a record since 2006 of 4.75-5%

The Federal Reserve System of the United States raised the key rate by 0.25 percentage points, to 4.75-5%.

"The Committee aims to achieve maximum employment and inflation at 2% in the long term. In support of these goals, the committee decided to raise the target range of the federal funds rate to 4.75-5.0%", - the Federal Reserve System said in a statement.

Currently, inflation in the country remains elevated. The Federal Reserve System considers it appropriate to tighten monetary policy. The forecast for inflation this year increased from 3.1% to 3.3%, and the forecast for 2024 remained at 2.5%.

In the period from March 8 to March 15 this year, banks in the United States borrowed a record $165 billion from the Fed. About $152.8 billion was issued as a short-term loan for up to 90 days. The previous record was set during the financial crisis of 2008 - about $111 billion.