Posted 21 июня 2023, 08:13

Published 21 июня 2023, 08:13

Modified 21 июня 2023, 08:25

Updated 21 июня 2023, 08:25

House of Cards: the collapse of the Chinese economy will drag the rest of the world with it

Unpleasant processes that will inevitably affect and Russia, and the rest of the world, originate in China. There, according to the experts of the Proeconomics channel, the former source of development stops working. It turns out that China financed an increase in its GDP by increasing public debt. But earlier, in order to increase it by 1 yuan, the growth of public debt had to be 1.5 yuan, now it is twice as much — 3 yuan.

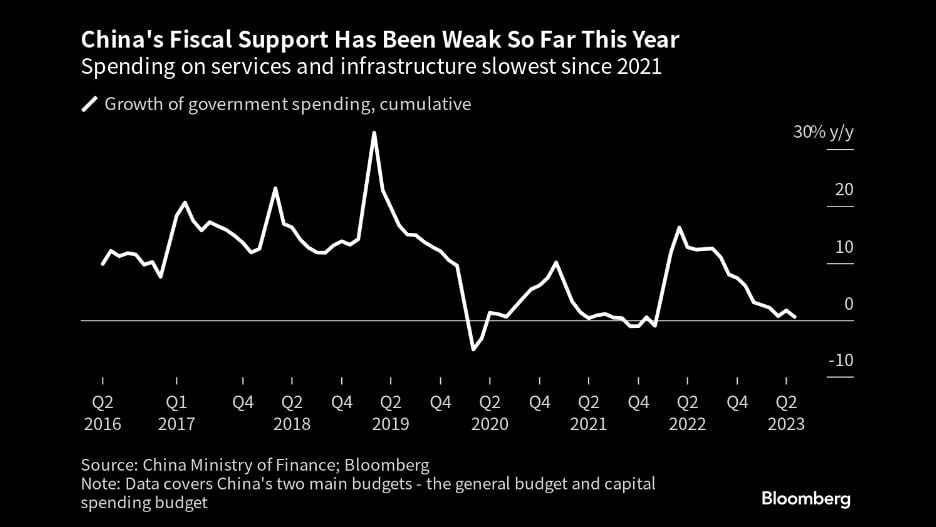

That is why state support for the Chinese economy in the second quarter of 2023 dropped to zero, that is, approximately as at the beginning of the covid pandemic in 2020.

Now, without the help of the state (various infrastructure projects), China's economy cannot grow, and it continues to increase the national debt, which has already reached astronomical figures — 330% of GDP.

In September 2022, the central government supported the economy with an infusion of 1 trillion yuan (about $150 billion), but this money was scooped out two months later: 300 billion yuan went to state banks to finance infrastructure projects and 200 billion yuan to support energy companies.

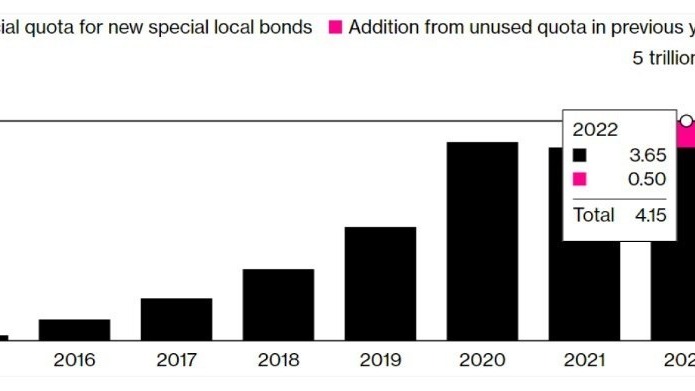

The provinces are not far behind the central government in this sense: the diagram shows their quotas for infrastructure bonds. The red part of the column for 2022 is an additional 500 billion yuan during the pumping of the economy with state money in September 2022.

In general, only for infrastructure projects, local governments increased the national debt by 4.15 trillion yuan (about $ 600 billion) in 2022.

In addition, starting in 2020, even a twofold increase in the debt of local governments on infrastructure projects was not able to disperse the country's economy.

That is, injections into the economy no longer work, but the reverse process occurs — the public debt becomes unaffordable for the economy.

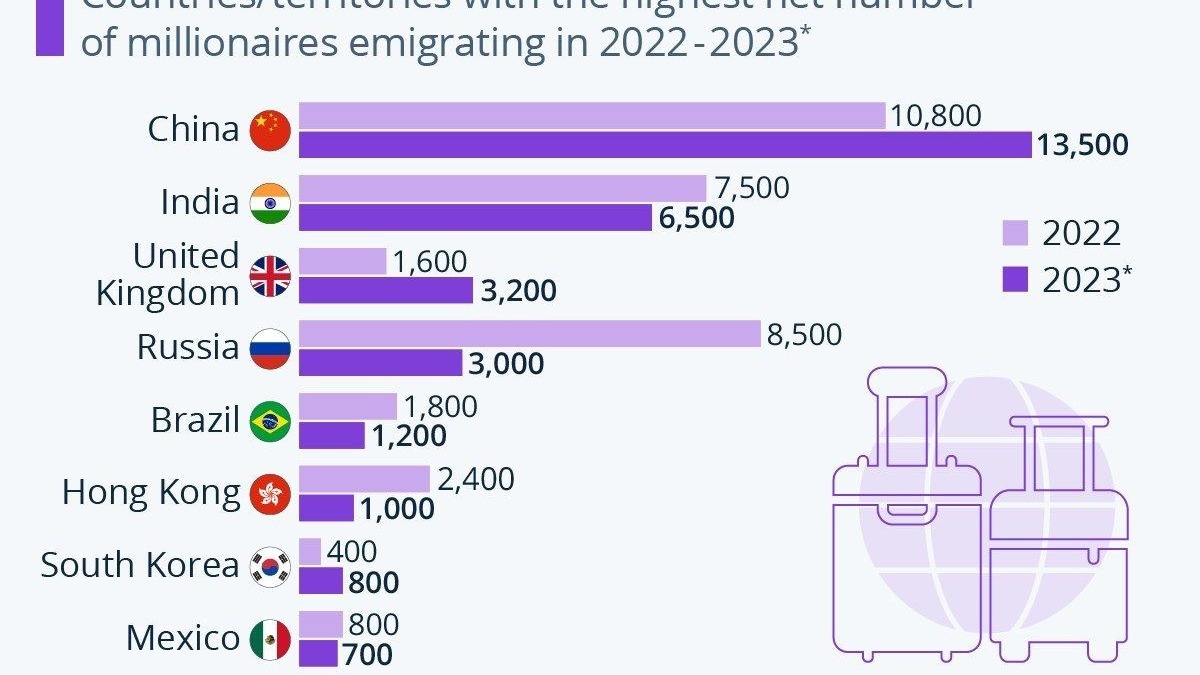

Analyst Anatoly Nesmian admits in this regard that he does not see prospects for the Chinese economy. For example, if full convertibility of the yuan is introduced, which allowed If China were to dump its accumulated debt into the global economy, capital flight would immediately begin. But China is already a world leader in the emigration of its most affluent citizens. With the convertible yuan, the analyst is sure, a huge number of people will run, washing out the last liquidity from the economy.

But the non-convertible yuan can be saved by the yuan zone, where China would economically, financially and politically dominate, monopolistically managing it. However, such a zone does not exist, and its creation will take a lot of time, which does not exist.

The analyst believes that China has such a choice. To create a yuan zone, you need a war, the chances of winning in which are minimal. The other way is the collapse of the model and the recognition of this fact by the country's leadership, after which it will be necessary to repeat the stagnant path followed by all the «Asian tigers». And it will take a long time — «for one or even two generations of Chinese.» Whether the Chinese, accustomed to the current consumer model, will be able to abandon it is a big question!

According to the analyst, America is afraid today not so much of Chinese military force as of a total global collapse that will cause the collapse of its economic model. This is indeed a very big risk for the most densely populated region of the Earth.

But economist Dmitry Prokofiev adds that any problems of the Chinese economy can turn into problems for the Russian economy, ranging from demand for Russian resources to China's ability (and desire) to supply everything necessary to our country:

«However, it may be that Beijing assumes that access to Internet resources will help mitigate the consequences of the crisis».