Posted 14 июля 2023, 06:25

Published 14 июля 2023, 06:25

Modified 14 июля 2023, 08:04

Updated 14 июля 2023, 08:04

Tax innovation: the Federal Tax Service will write off citizens' money without demand

What will the decision of the Federal Tax Service automatically deduct money from the cards of Russians lead to?

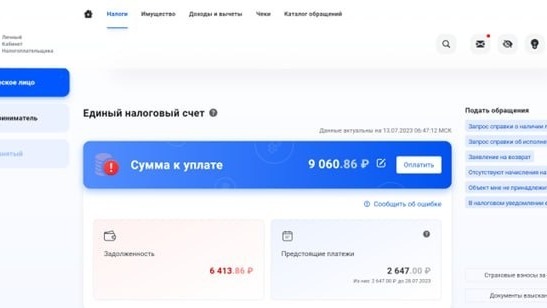

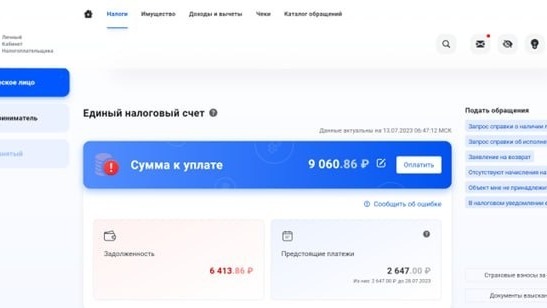

The big reform of the tax authorities began on January 1, 2023 — then the Unified Tax account was created. This is a virtual wallet on which all taxes paid are accumulated, and then distributed to various budgets. Both companies and individuals have ENS. On a national scale, the emergence of the ENS led to the fact that the regions were left without income from personal income tax, which companies pay for their employees. But individuals also have enough surprises related to the ENS.

Why reform is needed

The state is faced with an acute shortage of funds. The federal budget deficit by July 11, according to the «Electronic Budget», amounted to almost 3.4 trillion rubles — the Ministry of Finance does not manage to reduce it in any way. Largely due to the fact that in the first half of the year the country did not receive 528.6 billion rubles of oil and gas revenues. Anton Siluanov sees only one way out: now to postpone some expenses for 2024-2026, and in the future to «mobilize» resources to cope with the increased workload. The head of the Federal Tax Service, Daniil Egorov, did not wait for 2024 and is already ready to implement a «proactive tax payment procedure». That is, automatically deduct funds from the accounts of Russians immediately after sending a notification of the need to pay taxes.

Formally, such an innovation should make life easier for Russians: it will save people from pressing buttons to pay taxes and reduce the likelihood of arrears and penalties. In fact, it will speed up tax collection.

Where will the Federal Tax Service write off the money from

The Federal Tax Service will be able to write off money automatically only from the ENS. As befits a virtual wallet, the account balance can be either negative in case of arrears after invoicing, or positive if there are surpluses.

A positive balance of the Tax Service may arise if you voluntarily replenished it in advance, or if for some reason an overpayment was formed (it happens that the Federal Tax Service recalculates taxes over time and returns the overpayment), or you, for example, received a tax deduction. The last option is the most realistic.

Now there are 5 large categories of tax deductions: standard, social, property, investment deductions and «interest for interest». But all of them are tied to the personal income tax. That is, to use them, you need to have an official salary.

The case of automatic debiting

There are a lot of reasons for the appearance of a positive balance. But there are also enough reasons for automatic write-offs. So, for property taxes, the Federal Tax Service sends notifications a month before the deadline for payment (December 1 comes). Like it or not, the available deductions and overpayments will be written off in early November. This means that you will not be able to use the deduction and get a salary increase. The Federal Tax Service does not leave the opportunity to independently decide how and when to pay taxes.

Individual entrepreneurs and the self-employed should pay particular attention to their accounts. Now there is one tax bill for everything. And a sole proprietor can have a serious business with hired employees, payment of salaries and personal income tax, work with VAT. You have received a tax deduction for buying an apartment or paying for medical services — it can go to pay off tax arrears on your business. All the money is boiled in one pot of money.

Surely such a scheme will help to increase tax collection, but people are becoming less able to manage their own funds. The next stage in the framework of the «mobilization» of resources may be the linking of a bank card to the ENS and the automatic debiting of money from it. Now the self-employed can already enable autopayments in the «My Tax» application. So far voluntarily. But how long will such freedom last?